The fear of missing out, or ‘FOMO’ for short, can be a powerful motivator – except, apparently, when it comes to value investing. While some growth investors have been content for years to keep faith with the US tech giants, say – regardless of the assumptions about the future required to justify ever-higher valuations – the world of value enjoys one decent bounce at the end of 2020 and already there is talk of ‘missing the boat’.

Even the most cursory appraisal of the respective fortunes of value and growth since the 2008/09 crisis would indicate a few good months for the former cannot have come close to balancing out the decade-plus surge enjoyed by the latter. Still, the point is worth exploring in more detail and, having earlier discussed Missing November’s value rally in a UK context, let’s now look at the global case for upping your value exposure.

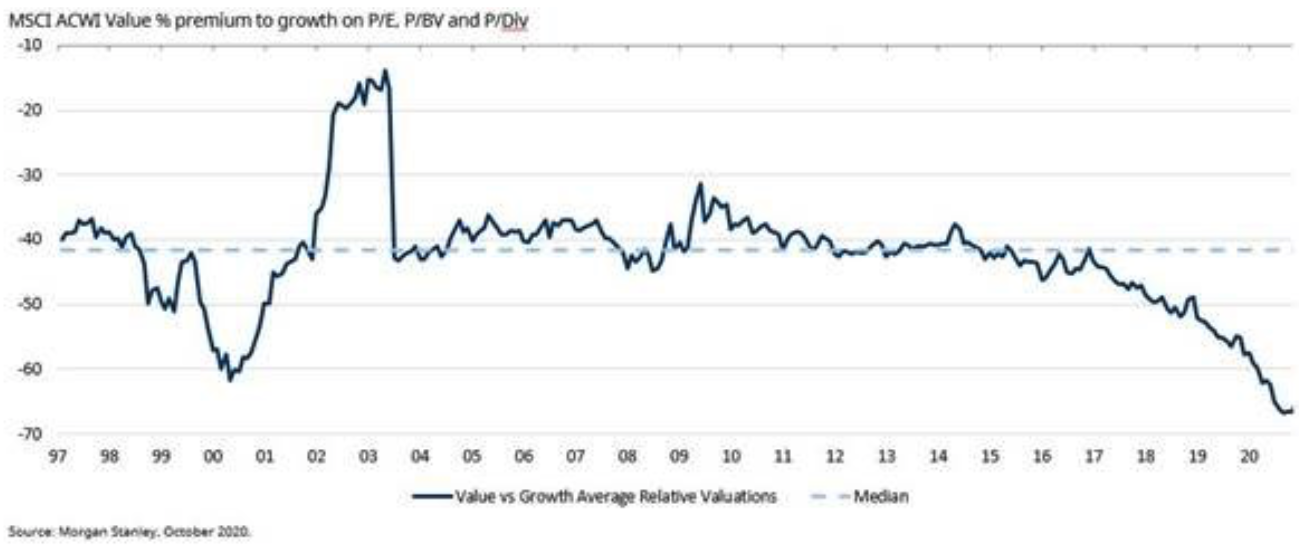

In articles such as Valuation risk, here on The Value Perspective, we have highlighted the huge dispersion in valuations that have built up between the value and growth investment styles over the last decade or so. As the following chart shows, across a blend of value metrics – price-earnings, dividend yield and price-to-book – on 31 October 2020, relative to growth, the MSCI ACWI Value index was trading at an all-time valuation low.

We have also urged investors to bear in mind how, like an elastic band stretched to its limit, valuations can snap back very quickly indeed – and, last November, we witnessed one of the largest two-day rotations from growth to value stocks on record. Ostensibly triggered by positive vaccine news and the US election result, the extraordinary share price moves were, in essence, a reflection of just how polarised markets had become.

A range of ‘work from home’ stocks, whose shares had directly benefited from the pandemic, saw prices lurch downwards. Leading world markets in the opposite direction, meanwhile, were a host of hitherto downtrodden and unloved businesses. There are two lessons to take from this, as we also noted in Missing November’s value rally – or perhaps the same lesson viewed from two angles.

Good news, bad news

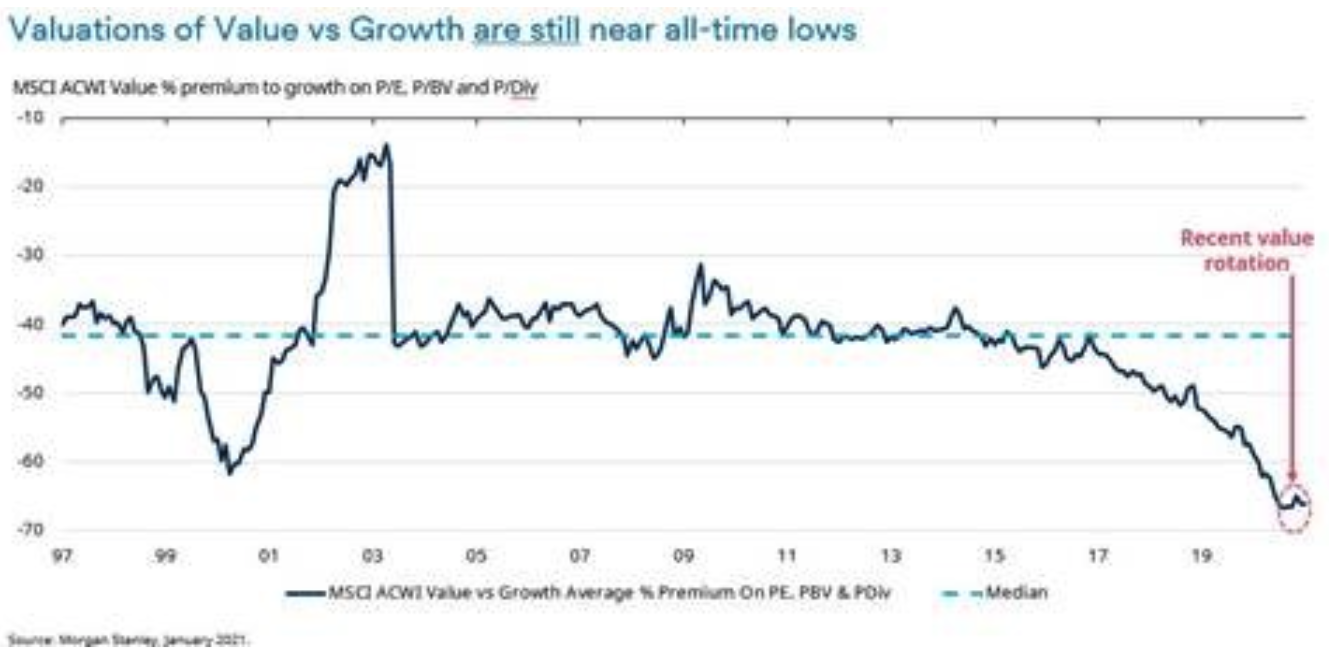

On the one hand, investors should remember that, when good news is already priced into a stock, any bad news can have a disproportionately negative effect. The flipside of that is, when you have bought a business on a cheap valuation, a little good news can go a long way – and, if we tick the above chart along one further quarter, you can now see the recent stellar outperformance of value circled on the far right below.

Still, if the outperformance was so stellar, you might well ask, why do we feel the need to highlight that part of the line? Why not allow it to speak for itself? But that is really our point: that uptick is speaking for itself – and doing double duty in doing so. In the context of a single quarter, it was a hugely morale-boosting bounce for value investors – and yet the fact it is dwarfed by the rest of the chart shows the potential that remains.

You can clearly see that, even after including the fourth-quarter rebound, valuations of value versus growth remain at historical lows – and well below where they were even at the peak of the dotcom bubble in early 2000. In other words, despite that recent bounce, the opportunity for value is still actually greater than in the period of ‘irrational exuberance’ that has come to epitomise the growthiest of growth-oriented investing.

Returns in the fourth quarter of 2020 were a reminder that, just as stocks that are ‘priced for perfection’ will eventually disappoint, so stocks trading at a discount to their underlying intrinsic value are unlikely to stay that way forever. And, when markets are all pointing in the same direction, history shows it can often end in significant pain for those who have put all of their eggs in one basket.

Range of outcomes

Here on The Value Perspective, we have never pretended to know what the future holds for anyone but we do know that it offers a range of possible outcomes – and investors should therefore seek to minimise the number of events that will have a negative effect on their portfolios while looking to maximise the number of events that will have a positive effect.

Heading through 2021, key questions facing investors would include: do I want to position myself for an economic recovery; do I need to diversify away from a quality or growth bias; given the market looks so stretched, should I pay more attention to valuation risk; and how can I benefit from ‘reflation’ – that is, the efforts of governments around the world to stimulate their economies as they emerge from lockdown?

Every one of those questions can be addressed in the same way: by increasing exposure to value-oriented investments. Here on The Value Perspective, we are convinced our portfolios comprise companies with both significant room to re-rate and a high probability of considerable profit recoveries. We do not profess to know when the tide will fully turn for value but, as things stand, there is still time to jump aboard this boat.

Important Information:

The views and opinions displayed are those of Nick Kirrage, Andrew Lyddon, Kevin Murphy, Andrew Williams, Andrew Evans, Simon Adler, Juan Torres Rodriguez, Liam Nunn, Vera German and Roberta Barr, members of the Schroder Global Value Equity Team (the Value Perspective Team), and other independent commentators where stated.

They do not necessarily represent views expressed or reflected in other Schroders’ communications, strategies or funds. The Team has expressed its own views and opinions on this website and these may change.

This article is intended to be for information purposes only and it is not intended as promotional material in any respect. Reliance should not be placed on the views and information on the website when taking individual investment and/or strategic decisions. Nothing in this article should be construed as advice. The sectors/securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy/sell.

Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.