Article by Hannes van den Berg and Rehana Khan

THE SA EQUITY PICTURE HAS CHANGED SINCE THE COVID LOWS. DOES THE RALLY IN LOCAL STOCKS STILL HAVE LEGS?

THE FAST VIEW

- During the early part of 2020, the earnings forecasts for domestic-oriented (SA Inc) stocks were downgraded sharply as the economy took a hit due to hard lockdowns.

- Our research on banks and retailers led us to conclude that conditions were not quite as dire as market consensus believed.

- In the third quarter of last year, we started tilting our portfolio towards SA Inc, capturing the upside when fundamentals and sentiment turned positive for local stocks.

- Despite material upgrades over the last few months, we see further upside to banks’ earnings.

- The prospects for retailers are also still positive. Bank-debt relief measures, COVID special grants, record low interest rates and insurance payouts have provided much-needed support to consumer wallets, which in turn have bolstered retailers.

- While global growth is slowing, it remains at or above trend, which is positive for equities, including emerging markets. Our portfolio retains a pro-cyclical tilt.

SA INC FATIGUE GOING INTO COVID

When domestic-oriented (SA Inc) stocks started looking promising some 18 months ago, many investors continued to sit on the sidelines. They were still replaying the negative SA Inc ‘movie’ of the last five years leading up to COVID, when local was not so ‘lekker’. During this period, feeble economic growth meant that SA retailers were under pressure and banks were struggling to hold onto their earnings (profits). Essentially, earnings forecasts for SA Inc companies were in a tough space.

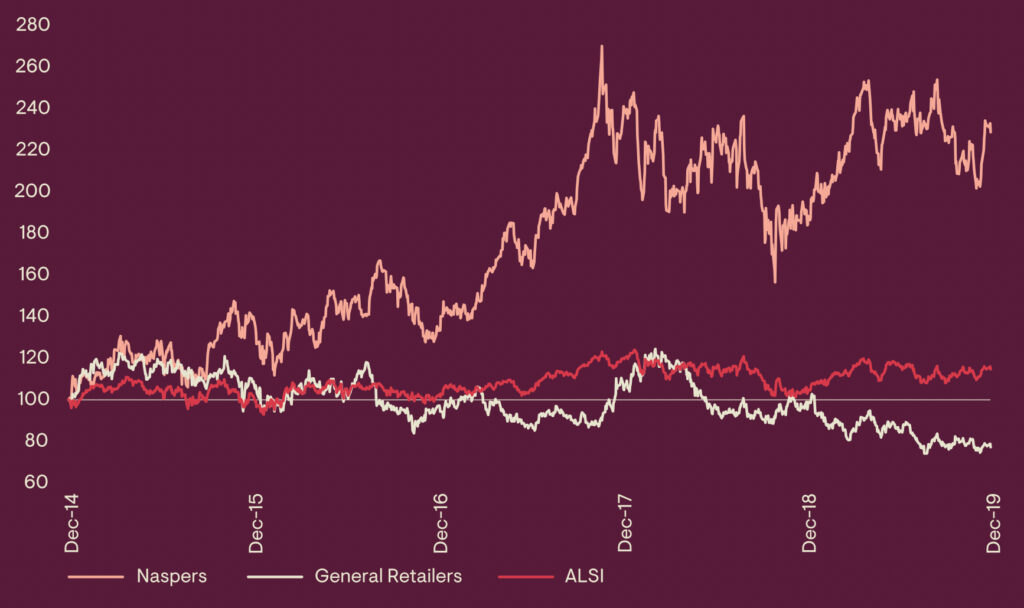

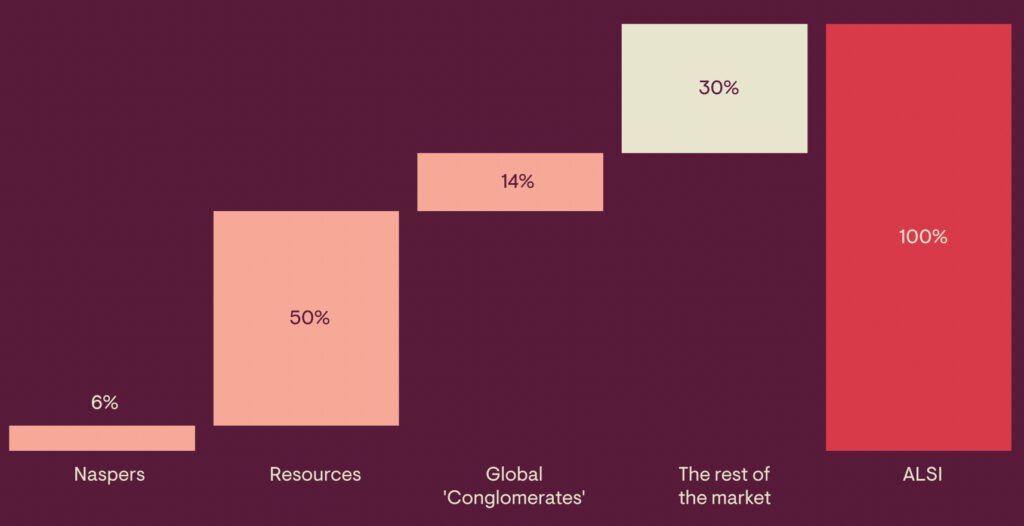

Investors made money by owning Naspers, resources stocks and global industrials listed on our exchange, while steering clear of SA Inc companies. As can be seen in Figure 1, Naspers contributed a staggering 41% of the FTSE/JSE All Share Index’s (ALSI’s) total cumulative gain over the five years to December 2019. During this period, retailers actually lost money for investors.

Figure 1: The 5 years before COVID – local was anything but ‘lekker’

Cumulative returns over 5 years

Contribution to our market’s return over 5 years

Source: Ninety One, Bloomberg, 5 years as at 31 December 2019. ‘Global Conglomerates’ reflect the combined weighted contribution of British American Tobacco, SABMiller/Anheuser-Busch and Richemont.

When COVID struck, the picture looked even bleaker for SA Inc stocks. Hard lockdowns meant that SA economic growth fell off a cliff, and with it domestic-oriented stocks’ earnings prospects looked poor. During the early part of 2020, the earnings forecasts for SA Inc stocks were downgraded sharply by 40%-50%. Analysts were predicting that some businesses’ earnings would be even lower than they were in 2019, which was already a challenging year for many local firms. These earnings downgrades drove the share prices of local stocks, such as banks and retailers, sharply lower.

“Sometimes, the broader market can be too positive or too negative on the earnings prospects for a company or sector.”

A REVERSAL OF FORTUNES

Sometimes, the broader market can be too positive or too negative on the earnings prospects for a company or sector. Our job is to find the opportunities that the broader market has not yet identified and avoid investments that may not be as attractive as the consensus view holds. During the middle of last year, our research on banks and retailers led us to conclude that conditions were not quite as bad as market consensus believed. Our earnings forecasts for banks and retailers were materially different from consensus forecasts. We anticipated that the earnings forecasts for some of the stocks in these sectors would be revised upwards, thanks to a raft of support measures for consumers, and banks facing fewer bad debt write-offs than expected.

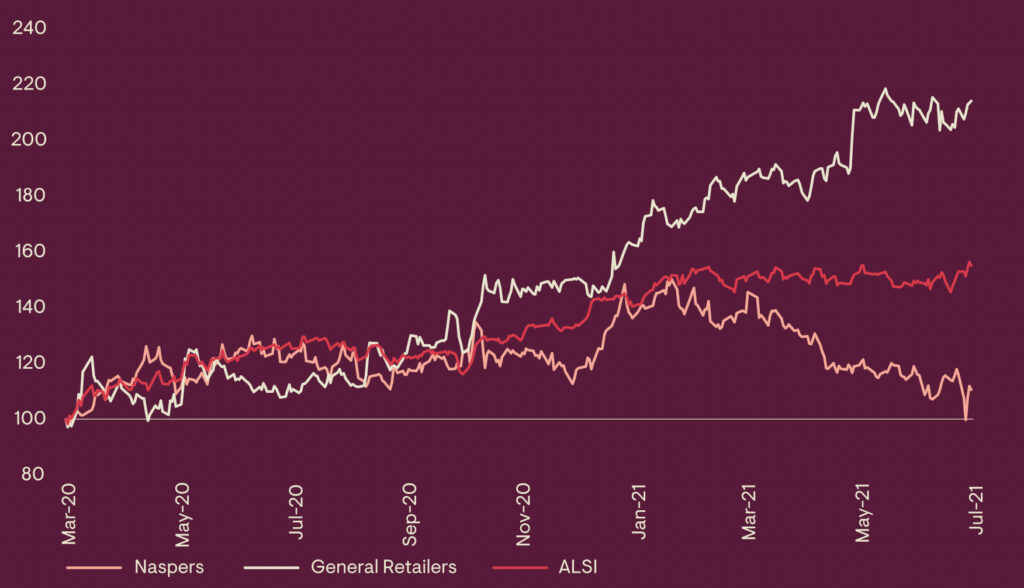

A company’s share price tends to move up when you have a series of upward revisions in earnings forecasts. On the flip side, downward revisions in earnings forecasts, usually drive a company’s share price lower. So, we allocate capital to stocks where expected future earnings are being revised upwards, and we like to buy these at reasonable valuations. In the third quarter of last year, we started tilting our portfolio towards retailers and banks, capturing the upside when sentiment turned positive for local stocks. As Figure 2 shows, SA Inc stocks contributed almost a third of the ALSI’s 60% gain since March 2020, while the contribution from Naspers was only 6%.

Figure 2: The SA equity picture has changed since the COVID lows

Cumulative returns since March 2020

Contribution to our market’s return since March 2020

Source: Ninety One, Bloomberg, – from 31 March 2020 to 31 July 2021. ‘Global Conglomerates’ reflect the combined weighted contribution of British American Tobacco, SABMiller/Anheuser-Busch and Richemont.

FINDING THE GEMS AMONG BANKS AND RETAILERS

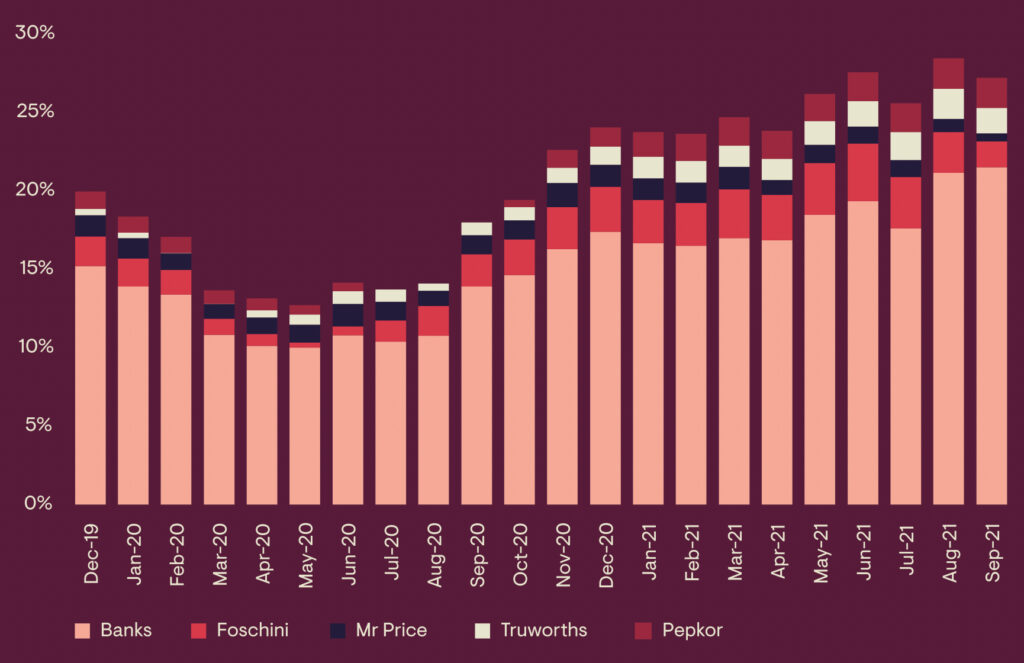

Our SA Inc holdings included apparel retailers like The Foschini Group and Truworths, and banks Absa, FirstRand and Capitec Bank. Despite material upgrades over the last few months, we see further upside to banks’ earnings. The COVID economic shocks meant that SA banks had to make substantial provisions for bad debts last year and we believe many of those provisions were overly conservative. Banks are experiencing fewer non-performing loans than anticipated. Non-interest income and transactional activity have also exceeded expectations. So, our holdings in the banking sector remain attractive to us.

“The prospects for retailers are also still positive. Bank-debt relief measures, COVID special grants, record low interest rates and insurance payouts have provided much-needed support to consumer wallets.”

The prospects for retailers are also still positive. Bank-debt relief measures, COVID special grants, record low interest rates and insurance payouts have provided much-needed support to consumer wallets, which in turn have bolstered retailers. The credit retailers have two levers that they can pull. They can either hold back on credit, and therefore have a better default experience, or they can use their credit lever to drive revenue by extending credit to the consumer. You don’t often find that credit retailers hold back on credit and have a bad debt experience. The market has penalised them for both. This sets the scene for potential upgrades in earnings forecasts, which creates opportunities for investors like us.

“We also have exposure to more defensive retail stocks such as Shoprite Holdings and Pepkor.”

We also have exposure to more defensive retail stocks such as Shoprite Holdings and Pepkor. Shoprite has successfully repositioned itself – exiting some of its business interests in Africa and addressing balance sheet concerns. New IT systems and refurbishments at some of Shoprite’s stores should also bolster profit margins. The group’s Checkers stores continue to trade well. Pepkor is benefiting from the extension of COVID grants into next year and consumers ‘trading down’ as they search for better value.

Figure 3: Capturing the opportunity as sentiment changes

Source: Ninety One, as at 30 September 2021.

RETAINING A PRO-CYCLICAL TILT – GLOBAL GROWTH SHOULD REMAIN SUPPORTIVE

We are now approaching the middle of the cycle where global economic growth is more moderate and broader equity market returns are typically more modest. Global market volatility reflects worries about higher inflation, slower growth, and a reduction in stimulus measures.

It is important to note that while global growth is slowing, it remains at or above trend, which is positive for equities, including emerging markets. Local cyclicals, such as banks and retailers, make up 38% of our SA equity exposure. Clearly, local is still ‘lekker’, and as outlined earlier, we remain positive on the outlook for the banking and retail sectors. Global cyclicals, which include diversified miners Richemont and Sasol, comprise 28% of our SA equity exposure. We expect global growth to still be supportive for stocks that are exposed to the global economy.

Valuations for the resources sector remain exceptional relative to strong earnings growth and cash generation. However, we expect volatility to remain elevated in the near term. Uncertainty around the pace of Chinese economic growth is weighing on the prices of commodities such as iron ore. Furthermore, supply chain disruptions have had a negative impact on demand and prices for platinum group metals (PGMs).

We have managed the risk and reduced our exposure to the diversified miners, especially those sensitive to the iron ore and the PGM market. At the same time, we have been increasing our active overweight positions in Glencore and Exxaro Resources. There has been a resurgence in demand for energy commodities, with insufficient supply to satisfy it. This has led to a rally in both coal and oil. Glencore is also benefiting from strong demand for copper, nickel and zinc. We have maintained our overweight position in Sasol.

The defensive stocks in our portfolio are an important diversifier, as these holdings are less sensitive to economic cycles. Well over a third of the SA equity portion of the portfolio consists of defensive stocks, which include Naspers, Prosus, MTN, Aspen and Bidcorp. While Naspers and Prosus have come under pressure due to regulatory headwinds, the long-term investment case remains strong for these companies. They also provide much-needed protection against potential rand depreciation.

In conclusion, we believe appealing valuations and a favourable earnings profile for the companies in our portfolio should generate attractive returns for investors over the medium to long term. The portfolio is actively managed with exposure adjusted to tap into those opportunities where earnings expectations as well as sentiment are improving, allowing us to keep our clients in the game.

Important information

All information provided is product related and is not intended to address the circumstances of any particular individual or entity. We are not acting and do not purport to act in any way as an advisor or in a fiduciary capacity. No one should act upon such information without appropriate professional advice after a thorough examination of a particular situation. This is not a recommendation to buy, sell or hold any particular security. Collective investment scheme funds are generally medium to long term investments and the manager, Ninety One Fund Managers SA (RF) (Pty) Ltd, gives no guarantee with respect to the capital or the return of the fund. Past performance is not necessarily a guide to future performance. The value of participatory interests (units) may go down as well as up. Funds are traded at ruling prices and can engage in borrowing and scrip lending. The fund may borrow up to 10% of its market value to bridge insufficient liquidity. A schedule of charges, fees and advisor fees is available on request from the manager which is registered under the Collective Investment Schemes Control Act. Additional advisor fees may be paid and if so, are subject to the relevant FAIS disclosure requirements.

Performance shown is that of the fund and individual investor performance may differ as a result of initial fees, actual investment date, date of any subsequent reinvestment and any dividend withholding tax. There are different fee classes of units on the fund and the information presented is for the most expensive class. Fluctuations or movements in exchange rates may cause the value of underlying international investments to go up or down. Where the fund invests in the units of foreign collective investment schemes, these may levy additional charges which are included in the relevant Total Expense Ratio (TER). A higher TER does not necessarily imply a poor return, nor does a low TER imply a good return. The ratio does not include transaction costs. The current TER cannot be regarded as an indication of the future TERs. Additional information on the funds may be obtained, free of charge, at www.ninetyone.com. The Manager, PO Box 1655, Cape Town, 8000, Tel: 0860 500 100. The scheme trustee is FirstRand Bank Limited, RMB, 3 Merchant Place, Ground Floor, Cnr. Fredman and Gwen Streets, Sandton, 2196, tel. (011) 301 6335. Ninety One SA (Pty) Ltd is a member of the Association for Savings and Investment SA (ASISA).

This document is the copyright of Ninety One and its contents may not be re-used without Ninety One’s prior permission. Ninety One Investment Platform (Pty) Ltd and Ninety One SA (Pty) Ltd are authorised financial services providers.