With the end of the 2019 tax year fast approaching, it is important to ensure you are making full use of the allowable contributions to both Retirement Funds and Tax Free Savings accounts prior to the end of February 2019.

A reminder of what is allowed and the benefits:

1. Retirement Fund contributions

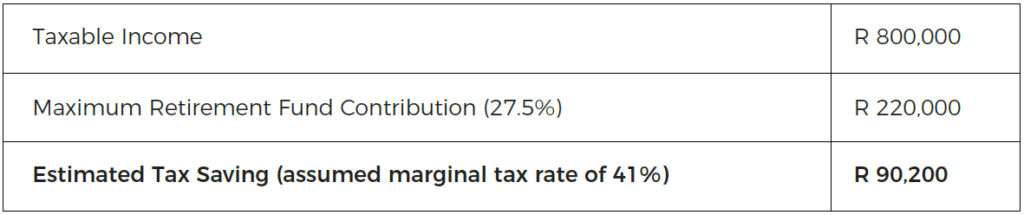

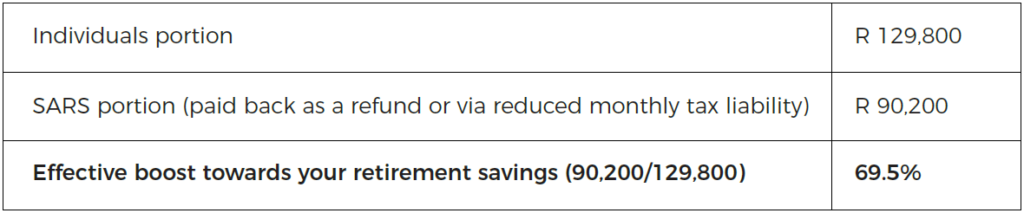

Every tax year you are able to make a pre-tax contribution of up to 27.5% of the higher of taxable income or remuneration, including taxable capital gains, but subject to a cap of R 350,000 per year.

A simple example illustrates the upfront tax benefit:

Technically speaking, the R 220,000 contribution can be viewed as follows:

The advantage is clear and we believe every individual should make use of the opportunity to reduce your tax liability and boost your retirement savings.

In addition to the upfront tax benefits, within the structure, the capital is able to grow free from Income Tax, Capital Gains Tax, Dividends Withholding Tax and Estate Duty.

It is important to remember that there will be a tax implication at some point, either as a retirement lump sum benefit or as income tax on the annuity income post retirement. The intention is that any future tax liabilities on the proceeds will likely be at a lower marginal tax rate than the upfront deduction, creating a tax arbitrage over time. You are also able to take the first R 500,000 out as a tax free cash commutation on retirement, resulting in the full benefit applying to this portion.

Common misconceptions:

a) May I contribute when I have already retired?

Contributions are also deductible against passive income such as pension, annuity and rental income. As a result, even pensioners are able to make use of the tax deductible contributions assuming there is still a benefit to doing so.

b) I don’t have any cash available to make a contribution this year

Assuming there is a tax advantage and you have discretionary investments available, it may make sense to repurchase one of your unit trusts to finance the contribution.

c) I don’t want to tie up my funds and have no access until retirement

You are able to retire from your personal retirement annuities anytime from age 55, regardless of whether you have retired from employment or not. This retirement will be subject to the retirement options available based on the prevailing legislation. Prior to this, in the event that you formally emigrate, you are able to withdraw from your retirement funds, subject to the withdrawal tax tables.

2. Tax Free Savings Accounts

Every individual is allowed an annual contribution of R 33,000 to a tax free savings account of their choice. This contribution is capped at R 500,000 over your lifetime, resulting in just over 15 years of full contributions.

There is no upfront tax deduction, however the capital is able to grow free from Income Tax, Capital Gains Tax and Dividends Withholding Tax within the structure.

It is important to remember that total contributions are not reduced by withdrawals, meaning any amount redeemed may not be replaced. We would therefore not recommend tying up any savings that may be needed in the short to medium term due to the adverse withdrawal implications. There is however no tax or penalties on any withdrawals.

It is also important to note that any amount contributed above the R 33,000 per annum will be penalised and taxed at a rate of 40%. This penalty aggregates any tax free savings accounts in your name across any number of providers. It therefore doesn’t make sense to over-contribute.

There are a variety of options for underlying investments within the tax free savings structure, ranging from lower risk, income type assets to high risk, capital growth options. We believe that the tax free savings account should be left untouched for as long as possible and therefore, given the long term investment horizon, we generally recommend high risk, high growth portfolios in order to benefit from the lack of Capital Gains Tax on the portfolio.

Should you require any assistance with calculations or contributions to either of the options above, please do not hesitate to contact us. You have until the end of February 2019 to make use of the contributions for the current tax year, however the product providers impose an earlier deadline, allowing sufficient time for investment prior to this date.

Article by: The Independent Wealth Managers Team